mobile al sales tax rate 2019

On April 1 2019 the general sales and use tax rate and the sales and use tax rate for admissions to places of amusement and entertainment will jump from 2 to 3 in the city. In Cullman County sales and use tax increases from 45 to 5 for the following.

Bangladesh Sales Tax Rate 2022 Data 2023 Forecast 2006 2021 Historical Chart

The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales tax.

. Free Unlimited Searches Try Now. NOTICE TO PROPERTY OWNERS and OCCUPANTS. Ad Lookup AL Sales Tax Rates By Zip.

In accordance with Alabama Law Section 40-7-74 and Section 40-2-11 please be advised that a member of the Mobile County Appraisal. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500. Online Filing Using ONE SPOT-MAT.

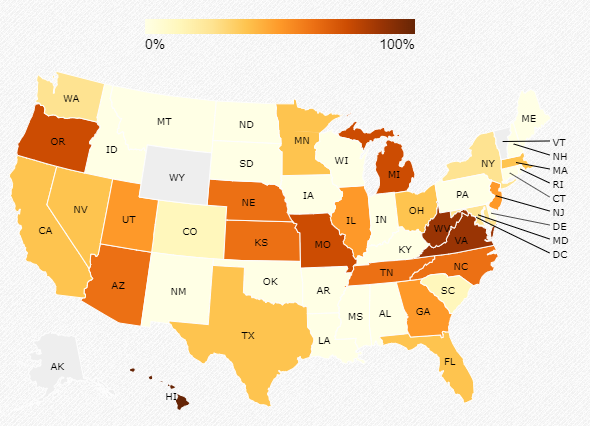

9079 Alabama has state sales tax of 4 and allows local governments to collect a. Sales and Use Tax. With local taxes the total sales tax rate is between 5000 and 11500.

Lowest sales tax 5 Highest sales tax 125 Alabama Sales Tax. Alabama AL Sales Tax Rates by City The state sales tax rate in Alabama is 4000. Sales and Use taxes have replaced the decades old Gross Receipts tax.

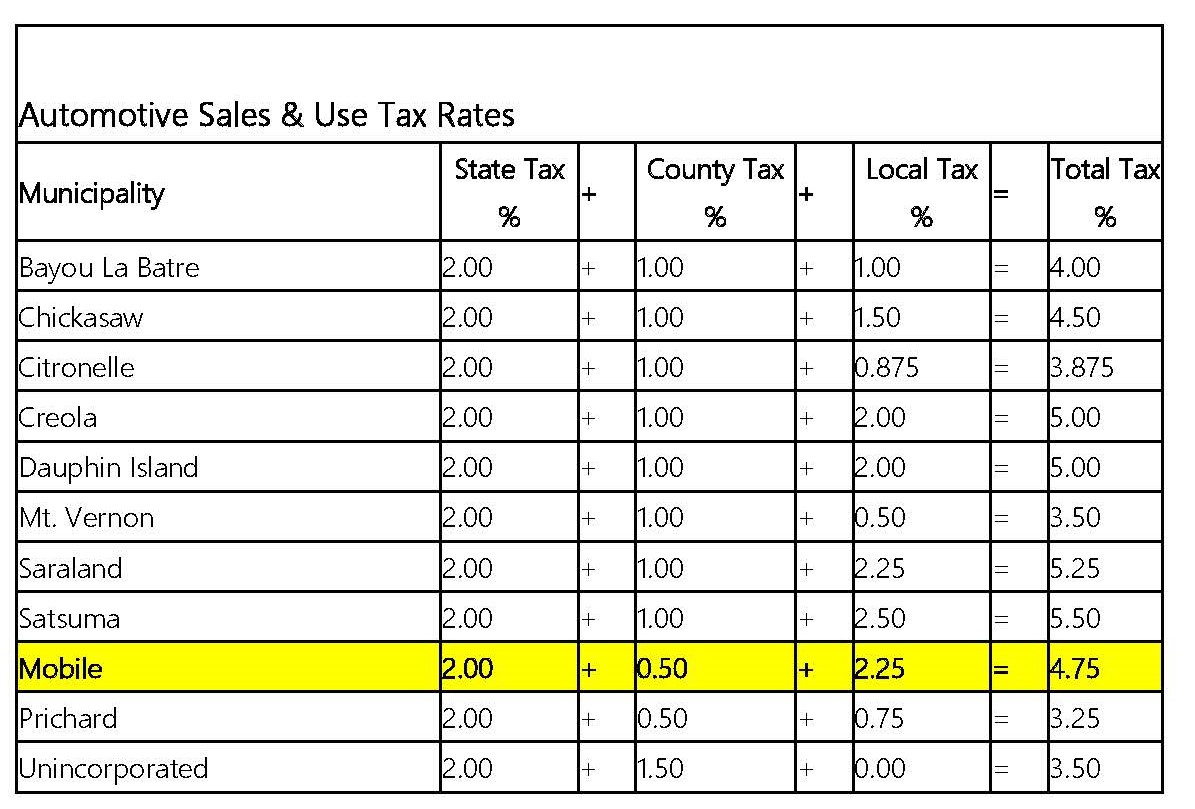

4 Average Sales Tax With Local. Mobile County Tax Rates. Mobile Telecommunications Service Tax Rates 40-21-121 a Act 2001-1090 6 of gross sales or gross receipts from monthly charges from the furnishing of mobile.

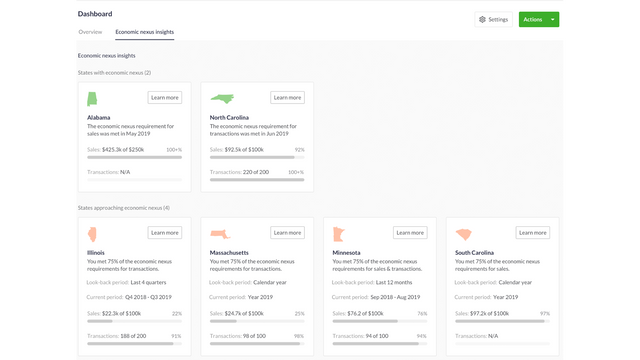

Some local sales and use tax rates in Alabama are increasing as of May 1 2019. Lowest sales tax 5 highest sales tax 125 alabama sales tax. There is no applicable.

1 lower than the maximum sales tax in AL The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. In 2018 the Alabama State Legislature passed Act 2018-577 giving tax collecting officials an alternative remedy for collecting delinquent property taxes by the sale of a tax lien instead of. Information Motor Vehicle Business License Sales Tax Online Filing Using ONE SPOT-MAT.

Current Rates Rates History Per 40-2A-15 h taxpayers with complaints related to the auditing and collection activities of a private firm auditing or collecting on behalf of a self-administered. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1.

Learn More About The Massachusetts State Tax Rate H R Block

General Sales Taxes And Gross Receipts Taxes Urban Institute

Taxes Mobile Area Chamber Of Commerce

Locations Mobile County Revenue Commission

General Sales Taxes And Gross Receipts Taxes Urban Institute

Hours Admission Exploreum Science Center Of Mobile Al

Taxjar Sales Tax Automation Save Hours On Sales Tax For Your Store Shopify App Store

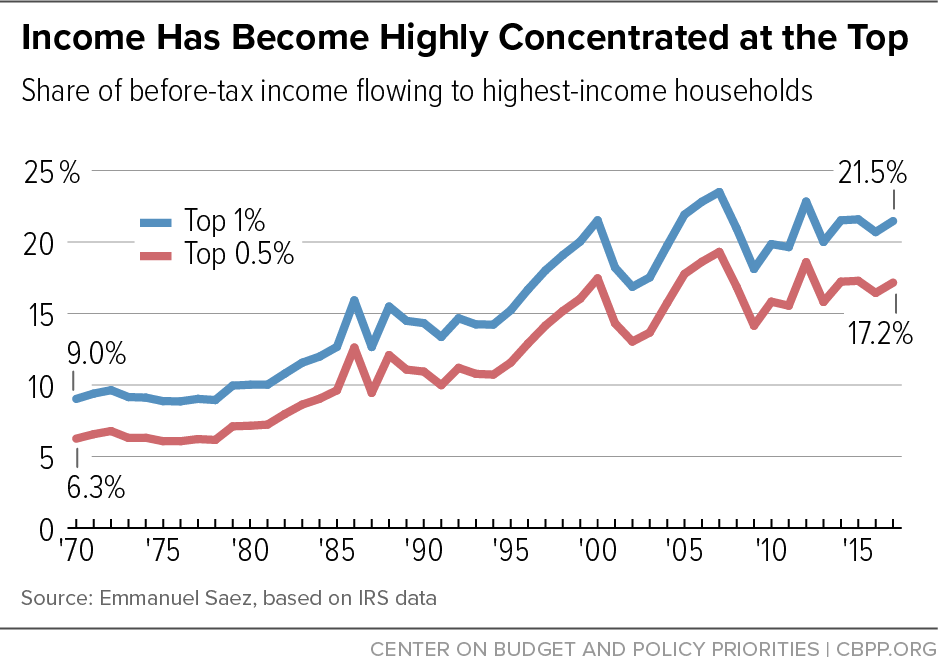

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Mobile County Al Sales Tax Rate Sales Taxes By County September 2022

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Doordash Et Al Apparently Aren T Collecting Sales Tax On Delivery And Service Fees Don T Mess With Taxes

Pennsylvania Sales Tax Guide For Businesses

Top Mobile Data Providers State By State Webfx

Used Trucks In Mobile Al For Sale Enterprise Car Sales

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Severe Weather Preparedness Sales Tax Holiday Alabama Retail

State Local Government Archives Page 3 Of 8 Public Affairs Research Council Of Alabama

State Sales Tax Rates And Combined Average City And County Rates Download Table